FINANCE COMMUNITY EXPERT: Claritas Wealth

Budget 2025 – sitting tight was a good option by Tim Walsham, Claritas Wealth.

Budget 2025 – sitting tight was a good option

by Tim Walsham, Claritas Wealth

Before the Autumn 2025 Budget we understandably had many clients concerned that they should be taking action in order to pre-empt changes that may be made by the Chancellor.

Our general stance was that if you were going to do something anyway in the very near future (e.g. making a large gift or taking the lump sum from a pension for a specific purpose) then it maybe made sense to do this before the Budget.

Otherwise the stance was to sit tight and wait. If we acted on every rumour before every Budget then financial planning would be an unstructured, chaotic business.

Yet again this proved to be the right course of action.

There have been some changes but we can now consider them calmy and carefully and continue to construct sensible, robust financial plans.

If you’d like to discuss how you might be affected by the Budget changes, please do get in touch. No charge for a chat.

FINANCE COMMUNITY EXPERT: Claritas Wealth

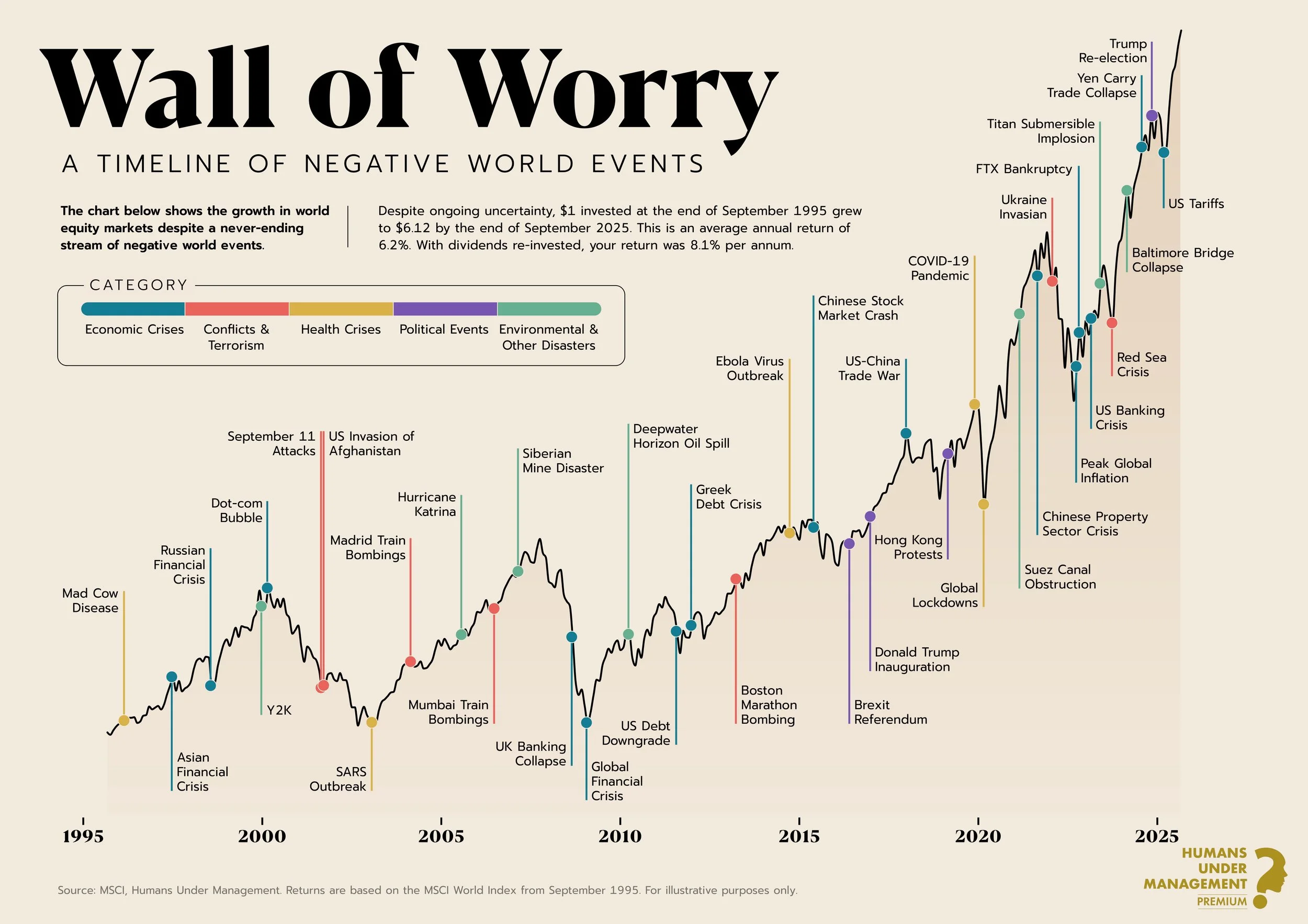

The Wall Of Worry: the timeline of negative world events and the corresponding growth of the global equity market, by Tim Walsham, Claritas Wealth.

Wall of Worry

by Tim Walsham, Claritas Wealth

A timeline of negative world events and their effects on the economy

It can feel that there’s a never ending stream of negative world events that dominate the news. I’m not looking to downplay the significance of any of these events but to highlight how resilient global stock markets are in spite of everything.

Yes, we experience temporary declines but the long term rise in markets is relentless. Each time a major negative event occurs, the press will write that ‘this time it’s different’ and that everyone should bail out of their investments. History being our guide, it will be a temporary decline and long term investors will be rewarded for patience and fortitude.

The chart relates to the global stock market and, in practice, many investors hold a portion of their portfolios in defensive assets to reduce the ups and downs to a level that they’re comfortable with. It’s important that any investor has a portfolio that they are able to stick with through thick and thin.

But the message is that, over timescales that are relevant to most investors, global stock markets are hugely resilient.

Not much more to say than that; I just thought that this is a really interesting chart!

FINANCE COMMUNITY EXPERT: Claritas Wealth

The change to pensions that the government would love to make by Tim Walsham, Claritas Wealth.

The change to pensions that the government would love to make

by Tim Walsham, Claritas Wealth

There are lots of rumours flying around in relation to changes that Rachel Reeves may make to the tax system to top up the country’s coffers.

There’s the potential further restriction of the maximum lump sum that can be taken out of pensions.

Lots of talk as well about further changes to inheritance tax, including the lengthening the amount of time that it takes for a gift to fall out of your estate from 7 years to 10 years or longer.

Also the perennial discussion about capital gains tax and the disparity between the rates of tax paid on income and gains. Will they dare equalise income tax and capital gains tax rates? It would be a bold move. Who knows?

The change that the past few governments have been itching to make though is to amend the income tax (and National Insurance) relief system for pension contributions.

Pensions tax relief cost the government circa £52 billion in 2023/24 and over 60% of this relief was used to reduce higher rate (40%) or additional rate (45%) income tax bills.

I’m not saying that the government are looking to scrap pension tax relief completely. It’s really important to provide encouragement and incentives to save for the future in order to reduce reliance on the State.

I’d say that what they would love to do (but are scared to do so) is get rid of higher and additional rate pension tax relief.

Watch this space.

FINANCE COMMUNITY EXPERT: Claritas Wealth

Your latest news and advice from Claritas Wealth by Tim Walsham: Financial planning – a journey not a destination

Financial planning – a journey not a destination

by Tim Walsham, Claritas Wealth

I realise that’s all a bit ‘X Factor’. Everyone is on a journey these days!

In the case of financial planning though it really is a journey.

The idea that we’ll reach a stage of our lives when everything is all sorted is pretty fanciful. There’s a great book by Oliver Burkeman called ‘Meditations for Mortals’ where he quotes a popular American social commentator/philosopher, Sam Harris.

Harris said that he finally realised in his 40s that he had been waiting for and expecting a stage in his life when he’d figured everything out and all of the issues and problems in his life fell away because he’d worked through them all. It was freeing when he realised that every stage of life has it’s own challenges to be dealt with and that will never change.

As an example, we may think that we’ll stop worrying about our children when they grow up but that’s not the case. We just have different worries as we never stop being a parent.

So if we create a financial plan now where we work out what’s important to you and try and plan for it, the one thing we know is that the plan will be wrong. That’s not to say it’s a worthless exercise; we’re just having the best stab at it now as we can.

The next time we revisit the plan we’ll have another best effort and ‘course correct’ as required. Sometimes these will be minor adjustments and sometimes life throws a complete curve-ball and major revisions are required. That’s life.

All I’d say is that in the long run this approach to financial planning really works. I’ve been creating financial plans for my clients for over two decades and the regular ‘course correcting’ keeps us on the right path, even if there is no final destination!